corporate tax increase uk

The increase is projected to bring in additional revenues of 119 billion in 2023-24 rising to 172 billion in 2025-26. The United States imported 68 billion watts worth a value of 49 billion in 2018 under the four subheadings.

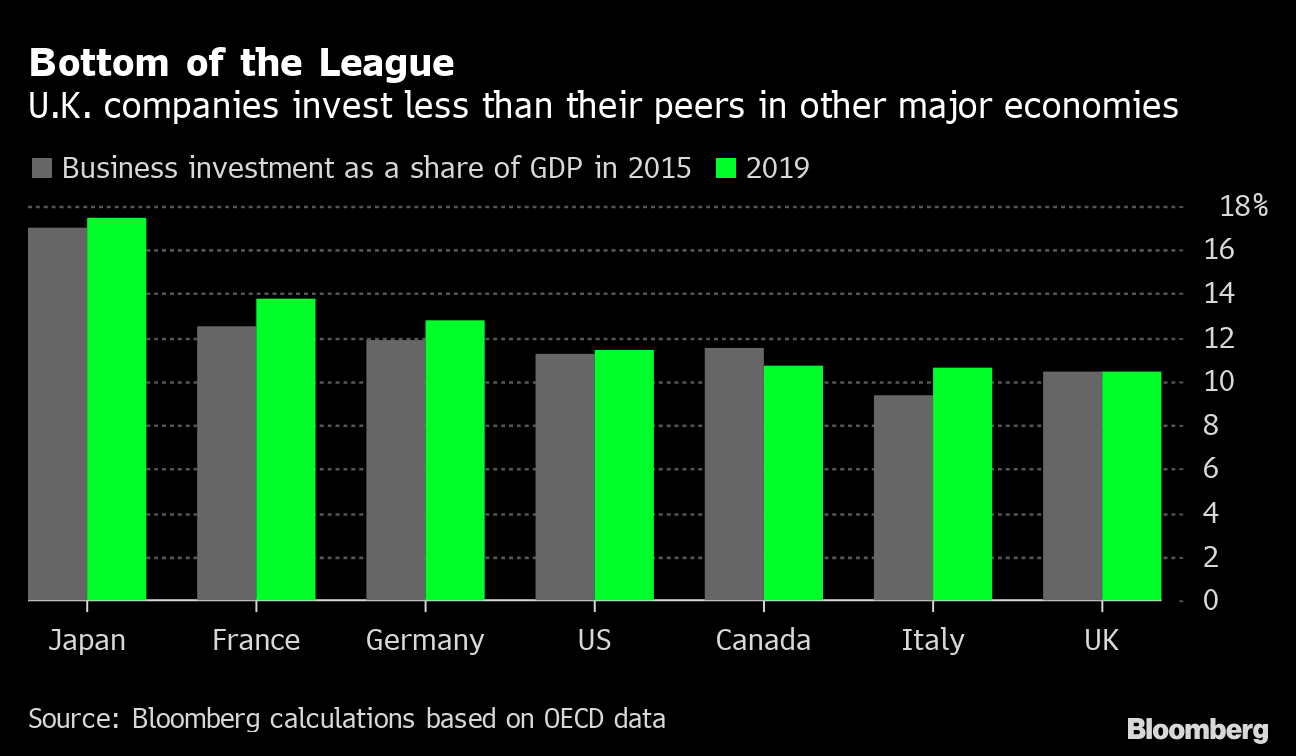

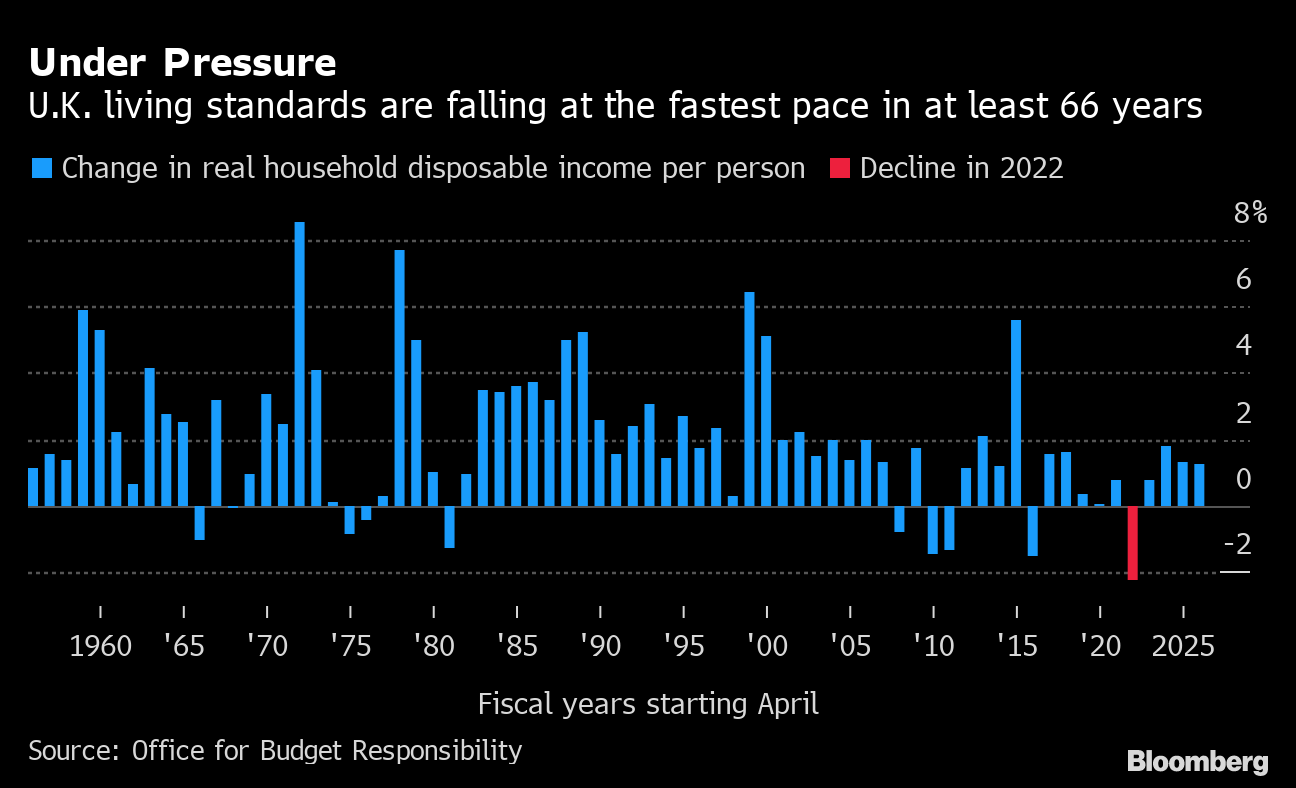

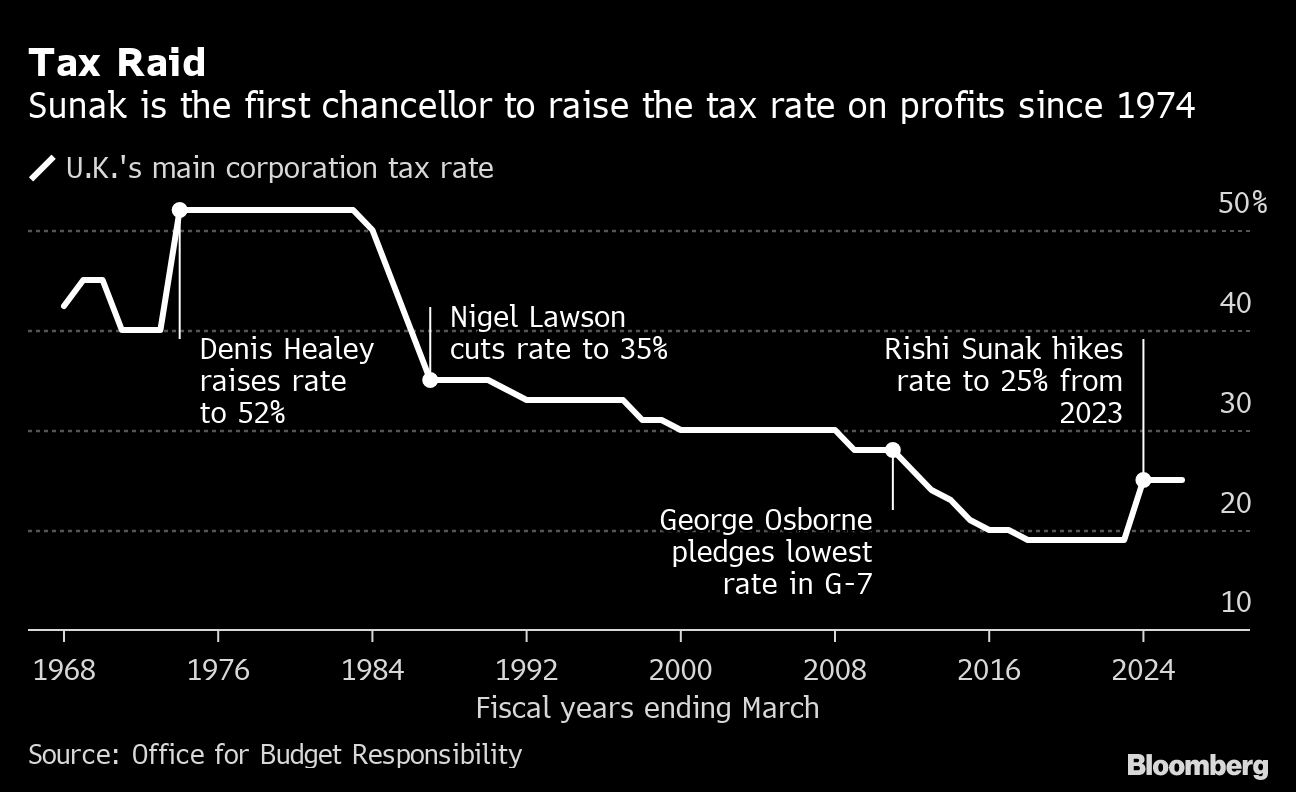

Sunak S Tax Cut Agenda Highlights A Weakness In The Uk Economy Bloomberg

The taxes may also be referred to as income tax or capital taxA countrys corporate tax may apply to.

. Varies according to the size of the company making the payment. The amount of qualifying RD expenditure used to claim RD tax relief is estimated to be 475 billion for the year ending March 2020 an increase of 15 from the previous year figure 3 and. We estimated the solar cell and module tariffs amount to a 02 billion tax increase based on 2018 import values and quantities of four 8-digit Harmonized Tariff Schedule subheadings given on page 12 of this report.

Effective Less than INR 10 million. Income CIT rate Turnover does not increase INR 4 billion in FY 202021. The corporate income-tax CIT rate applicable to an Indian company and a foreign company for the tax year 202122 is as follows.

Some 136 countries agreed a global deal in October 2021 to ensure big companies pay a minimum tax rate of 15 and make it harder for them to avoid. Many of Irelands corporation tax tools are OECDwhitelisted and Ireland has one of the lowest. At 125 Ireland has one of the lowest headline tax rates in Europe Hungary 9 and Bulgaria 10 are lower.

23 Is VAT or any similar tax charged on all transactions or are there any relevant. Varies according to the size of the company making the payment. In line with the 6 percent CT rate increase the rate of Diverted Profits Tax will also increase by 6 percent to 31 percent from April 2023.

United Kingdom Last reviewed 30 December 2021 The tax return needs to be filed within one year from the end of the accounting period. An introduction to corporate finance legislation covering loan relationships. To help us improve GOVUK wed.

For other domestic companies. Other tax rules on corporate debt. There has been no rate reduction in response to COVID-19.

This increase took effect from 1 February 2020. Many countries impose such taxes at the national level and a similar tax may be imposed at state or local levels. Corporate Tax Laws and Regulations covering issues in Nigeria of Tax Treaties and Residence Transaction Taxes Cross-border Payments Capital Gains.

As of November 2018 the key attributes that tax experts note regarding the Irish corporate tax system are as follows. OECD average is 249. A corporate tax also called corporation tax or company tax is a direct tax imposed on the income or capital of corporations or analogous legal entities.

The European Parliament overwhelmingly backed the European Unions adoption of a global minimum tax for companies on Thursday and urged the bloc to allow a review after five years that could tighten controls. See the UK Corporate summary for more information.

Richard Burgon Mp On Twitter Richard Investing Twitter

Us Corporate Tax Rate Compared To Other Countries Business Infographic Small Business Infographic Infographic

Pin By Ken Voorhees On Graphs Economic Analysis Graphing Corporate Tax Rate

Windfall Tax Uk S Rishi Sunak Slaps 25 Levy On Profits Of Oil And Gas Firms Bloomberg

Dns Accounting Services In Portsmouth Uk Http Www Dnsassociates Co Uk Accountants In Portsmouth Accounting Services Tax Prep Payroll Accounting

Corporate Tax By Country Around The World Infographic Infographic Around The Worlds Corporate

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

Importance Of Cost Accounting In The Medical Practice Http Www Harleystreetaccountants Co Uk Importance O Cost Accounting Company Structure Medical Practice

A Uk Company Is A Good Solution For Digital Nomads Tax Consulting Uk Companies Corporate Tax Rate

Pin By Eris Discordia On Economics Net Worth The Unit Economics

U K Pushes For Finance Exemption From Global Taxation Deal Advanced Economy London City Global

The Simple Reason Why Donald Trump Is Great For Corporate America Show Me The Money Stock Market How To Plan

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

5 Businesses Running Rings Round Hmrc Tax Research Uk Infographic Business Corporate

Sunak S Tax Cut Agenda Highlights A Weakness In The Uk Economy Bloomberg

How To Fund Basic Income In The Uk Part 3 Carbon Tax And Dividend Land Value Tax Dividend Income

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

United Kingdom Corporation Tax Wikipedia In 2021 Financial Instrument Corporate United Kingdom

Budget 2012 George Osborne Raises Uk Growth Forecast Budget Forecasting Budgeting Smart Money